Raspberry Pi's stock surges 39% during its uncommon London market launch.

In a rare London market debut, Raspberry Pi's shares jump 39%.

Crucial Points

- The tiny single-board computer manufacturer Raspberry Pi priced its shares at 280 pence each.

- On Tuesday, Raspberry Pi shares started "conditional dealing."

- Some investors, such as institutional investors, begin trading shares during this time.

While performing its market debut on Tuesday, Raspberry Pi's shares increased by 39%. The British computing firm is hoping to collect approximately £166 million ($211.2 million) with its first public offering.

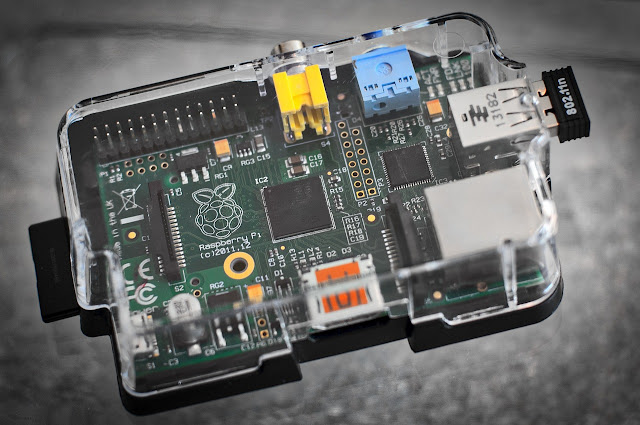

Raspberry Pi shares started "conditional dealing" on Tuesday, and full open trading is anticipated to start on Friday. After the company, which manufactures small single-board computers, set the price of its shares at 280 pence each, shares increased to 390 pence. The offering is viewed as a unique victory for the primary stock exchange in London, which has had difficulty luring technology listings.

The company's initial share price of £541.6 million determined its valuation.

The company's current majority shareholder, Raspberry Pi Mid Co Limited, a fully owned subsidiary of the Raspberry Pi Foundation, is selling 45.9 million common shares as part of the Raspberry Pi offering. In addition to 11.23 million newly issued shares, it also consists of 2.13 million common shares that have been sold by other shareholders.

A so-called overallotement option will let the Raspberry Pi Foundation to issue an additional 4.6 million shares in the event that demand exceeds supply. The most significant bid amount, if the overallotment option is used, will be £178.9 million.

In order to provide young people with more access to computing, Raspberry CEO Eben Upton founded the company in 2012. Numerous applications can be powered by its single board processors.

Although enthusiasts were its first users, the business claims that 72% of its unit sales are aimed toward the industrial market, where it is, for instance, utilized in factories.

Raspberry Pi reported $265.8 million in revenue in 2023, a 41% increase from the previous year.

The startup is supported by several well-known industry heavyweights, such as Arm and Sony. A Sony Corporation subsidiary, Sony Semiconductor Solutions, made an undisclosed investment in the British business last year.

Despite being tiny in comparison to other tech companies, the Raspberry Pi IPO has the potential to revitalize the floundering London market, which has been passed over by tech companies in favor of listings in other regions of Europe, especially the United States.

The U.K.-based chip designer Arm, owned by Softbank, decided to list in the United States last year.

No comments